Memory Stocks Rally as AI Trade Stalls, Highlighting a Shift in Market Leadership

Discover why memory stocks outperform AI trade in 2026 as investors rotate from headline tech names to foundational semiconductor components. Essential market analysis inside.

The Quiet Revolution Wall Street Almost Missed

Here’s something that might mess with your mental model of the AI boom: while everyone’s been hypnotized by Nvidia press conferences and GPT updates, a completely different corner of the semiconductor market has been absolutely crushing it. The phenomenon of memory stocks outperform AI trade has become one of 2026’s defining market stories.

We’re talking about memory stocks outperform AI trade narratives—and not by a small margin. SanDisk is up 871% since its spinoff. Micron has delivered 240% returns. Meanwhile, some of those AI darlings that dominated headlines in 2023 and 2024? They’re taking a breather, nursing elevated valuations, and facing uncomfortable questions about when all that infrastructure spending will actually pay off.

The memory stocks outperform AI trade trend isn’t a temporary blip. It represents a fundamental reassessment of where AI value actually accumulates.

If you’ve been paying attention to the markets in early 2026, you’ve likely noticed something peculiar happening. The memory stocks outperform AI trade phenomenon isn’t just a statistical quirk—it’s a genuine shift in how sophisticated investors are positioning themselves for what comes next in the artificial intelligence revolution.

Let me break this down for you, because understanding why memory stocks outperform AI trade matters whether you’re managing a portfolio in New York, Mumbai, Beijing, or anywhere else where capital flows follow logic.

Why This Matters: The Great Rotation Nobody Predicted

Impact on Global Investors

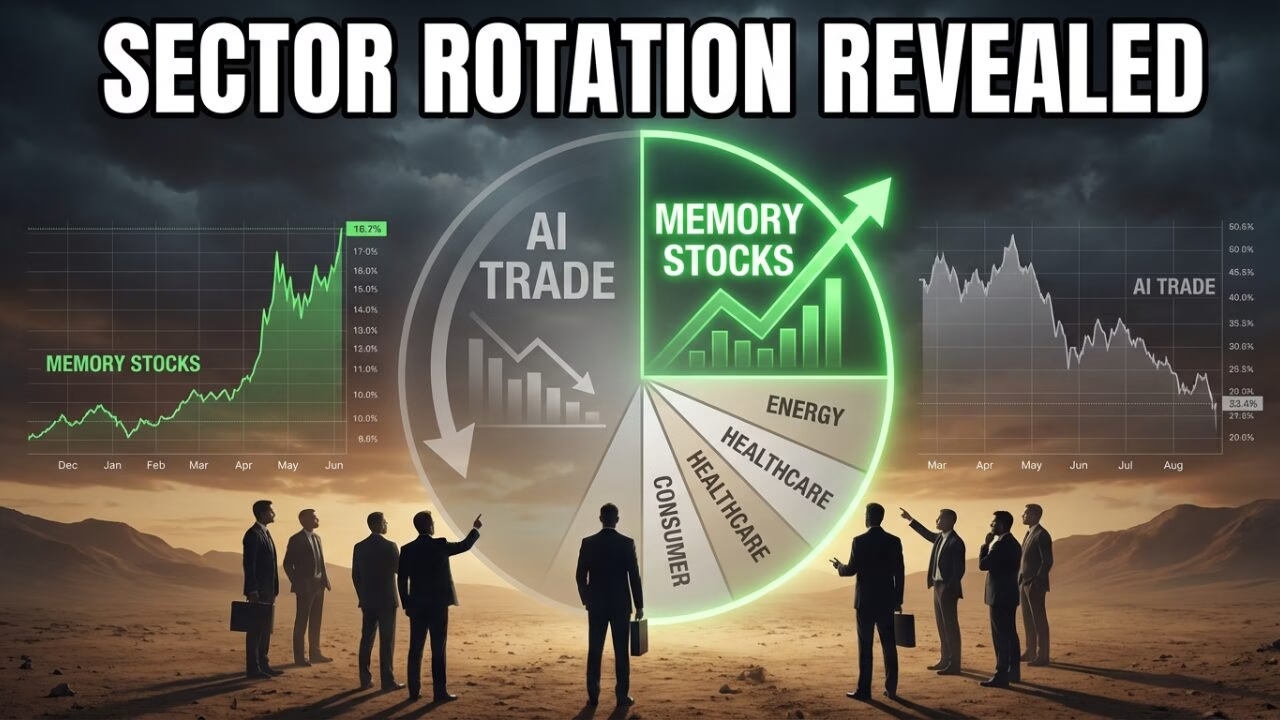

The fact that memory stocks outperform AI trade expectations signals something bigger than a sector rotation. It represents a fundamental repricing of where AI profits will actually materialize.

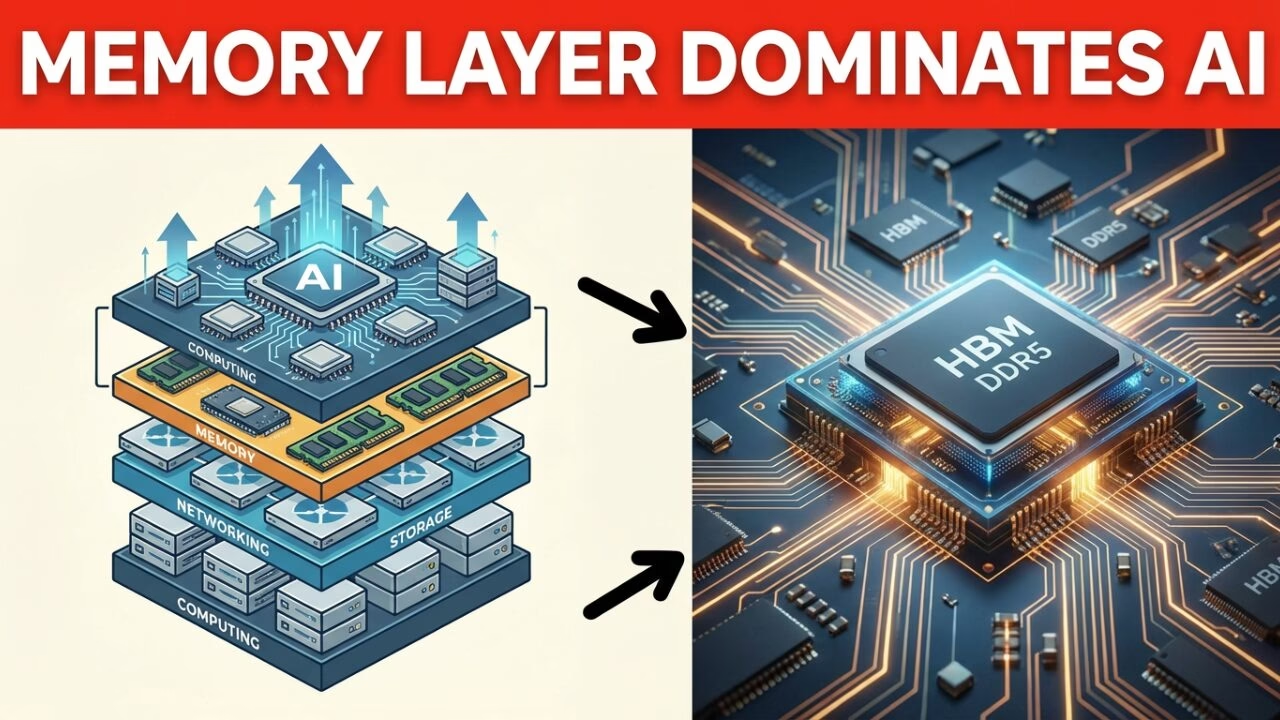

Think about it this way: for two years, investors piled into companies that made the “brains” of AI systems—the processors, the software, the cloud platforms. But here’s the thing about brains: they’re useless without memory. And that obvious truth finally hit Wall Street like a freight train in late 2025.

When memory stocks outperform AI trade favorites, it creates several implications:

- Sector rotation opportunities for traders who spotted the shift early

- Valuation reset across the semiconductor landscape

- New risk assessment frameworks for AI-related investments

- Geographic investment pattern shifts affecting markets from the US to Asia

DA Davidson analyst Gil Luria put it perfectly when he told Yahoo Finance: “Right now, we are very early in the memory cycle. The progress that we’ve made in AI models has made it so memory is the next frontier.”

That’s not analyst-speak hype. That’s a recognition that memory stocks outperform AI trade outcomes because they’ve become the new bottleneck. The memory stocks outperform AI trade thesis rests on this simple reality: AI needs memory, and there isn’t enough of it.

Broader Market Implications

The pattern of memory stocks outperform AI trade benchmarks suggests the AI growth story is entering a more selective phase. Not every company riding the AI wave will win. The market is getting pickier, demanding evidence of actual profits rather than just promises of future disruption. Understanding why memory stocks outperform AI trade expectations has become essential for anyone positioning portfolios for 2026 and beyond.

For investors in the US, the memory stocks outperform AI trade dynamic means reassessing semiconductor holdings. For those watching from China, where memory manufacturing capacity is expanding, it raises questions about supply chain dynamics and how memory stocks outperform AI trade might shift regional competitive dynamics. Indian investors tracking global tech trends should note how memory stocks outperform AI trade patterns might influence IT services demand. And for market watchers in Russia and other regions, the semiconductor supply chain restructuring—driven by how memory stocks outperform AI trade leaders—carries geopolitical implications worth monitoring.

What’s Actually Driving Memory Stock Gains?

The Supply-Demand Squeeze

When we examine why memory stocks outperform AI trade expectations, the answer starts with basic economics: supply and demand have gone completely out of whack. The fundamental reason memory stocks outperform AI trade benchmarks comes down to scarcity economics.

Here’s what’s happening on the ground, and why memory stocks outperform AI trade predictions:

| Factor | Impact | Timeline |

|---|---|---|

| Tight memory supply | Severe shortages across DRAM and NAND | Ongoing through 2026 |

| AI demand surge | Data centers need 3-5x more memory | Accelerating |

| Pricing power restoration | Contract prices up 20-40% Q/Q | Q1 2026 peak |

| Limited new capacity | New fabs take 2-3 years to build | Relief in 2027-2028 |

Micron CEO Sanjay Mehrotra dropped a bombshell in recent earnings calls: the company currently meets only 55-60% of core customer demand. Let that sink in. One of the world’s largest memory producers is turning away business because they literally can’t make enough chips.

This scarcity is exactly why memory stocks outperform AI trade incumbents. When you can’t buy something, its price goes up. When prices go up, margins expand. When margins expand, stocks rally.

The AI Infrastructure Reality Check

Here’s where it gets interesting. The reason memory stocks outperform AI trade heavyweights isn’t despite AI—it’s because of AI, just not in the way most people expected. When analysts investigate why memory stocks outperform AI trade darlings, they consistently find the same answer: AI’s appetite for memory exceeds everyone’s projections.

AI workloads are absolute memory hogs. Training a large language model requires bandwidth exceeding 1TB per second. Running inference at scale—which is where we’re headed in 2026 with agentic AI systems—demands even more storage capacity. Nvidia CEO Jensen Huang described the storage market as “completely unserved” at CES 2026, calling it potentially the largest storage market in the world. His comments validated why memory stocks outperform AI trade expectations.

That statement sent SanDisk stock soaring 27.5% in a single day.

The infrastructure that powers AI needs:

- High-bandwidth memory (HBM) for processing massive datasets

- Advanced DRAM for rapid data access

- Enterprise SSDs for storing AI models and training data

- NAND flash for edge AI applications

Every single one of these categories is experiencing unprecedented demand. And that’s precisely why memory stocks outperform AI trade darlings that rely on this infrastructure.

Morgan Stanley projects NAND flash memory prices will rise 30-35% in Q1 2026 alone. Samsung and SK Hynix are seeking 60-70% price increases for server DRAM. These aren’t marginal adjustments—they’re fundamental repricing of essential AI components.

Why the Broader AI Trade Is Cooling

So if memory stocks outperform AI trade names, what’s happening to those famous AI investments that dominated portfolios? Understanding why memory stocks outperform AI trade leaders requires examining what’s changing in the broader tech landscape.

Elevated Valuations Meet Reality

After two years of extraordinary gains, many AI stocks entered 2026 with valuations that assumed perfection. Nvidia trading at 25 times forward earnings. Software companies with 50x multiples. Cloud providers pricing in decades of dominance. This valuation reality check helps explain why memory stocks outperform AI trade alternatives.

The problem? Investors started demanding proof. The memory stocks outperform AI trade phenomenon accelerated as this skepticism grew.

A landmark MIT study released in August 2025 found that 95% of organizations had yet to see meaningful ROI from their Generative AI investments. That’s a sobering statistic when you’ve been buying stocks based on the assumption that AI would transform every industry overnight.

The Profit-Taking Phase

Multi-year winners attract sellers. It’s that simple. When memory stocks outperform AI trade veterans, part of the explanation is just mechanical: investors who rode Nvidia from $50 to $500 are taking some chips off the table. The memory stocks outperform AI trade narrative gains strength as this rotation accelerates.

Tom Essaye, founder of Sevens Report, observed that the initial unified enthusiasm for AI has become “fractured.” The industry is moving into a period where the market is aggressively sorting winners and losers. This fractured sentiment amplifies why memory stocks outperform AI trade darlings.

Capital Spending Scrutiny

The hyperscalers—Amazon, Microsoft, Google, Meta—have collectively pushed their annual AI infrastructure spending from $100 billion in 2023 to over $300 billion in 2025. Some projections show this exceeding $500 billion in coming years. As investors scrutinize this spending, the memory stocks outperform AI trade pattern intensifies.

That’s an enormous bet. And investors are starting to ask: when does this spending produce returns? The questioning validates why memory stocks outperform AI trade software plays.

Oracle’s Q4 2025 revenue miss, combined with a 40% increase in CapEx guidance to $50 billion, wiped $80 billion off the company’s value in a single session. The market sent a clear message: spending isn’t automatically rewarded anymore. This message reinforces the memory stocks outperform AI trade thesis.

This scrutiny creates room for memory stocks outperform AI trade leaders. While big AI spenders face questions about ROI, memory companies are posting record profits on constrained supply. The fundamental earnings power behind memory stocks outperform AI trade expectations can’t be ignored.

The Conflict and Novelty: What Makes This Story Newsworthy

The Narrative vs. Reality Divide

There’s a fascinating conflict at the heart of why memory stocks outperform AI trade expectations: the gap between AI hype and AI infrastructure reality. The memory stocks outperform AI trade story reveals this disconnect in stark terms.

For years, the AI investment thesis focused on the sexiest parts of the stack—the processors that train models, the software that runs them, the platforms that deploy them. Memory and storage? That was boring plumbing. Essential, sure, but not where the action was. Yet memory stocks outperform AI trade stars precisely because that assumption was wrong.

Except it turns out the plumbing is now the bottleneck. And when plumbing becomes scarce, plumbers get rich.

This is why the memory stocks outperform AI trade phenomenon caught so many investors off guard. They were watching the wrong part of the equation.

The Emergence of Quiet Winners

SanDisk’s 871% gain since its February 2025 spinoff represents one of the most remarkable stock performances in recent memory (pun intended). Yet how many mainstream financial news segments have you seen dedicated to NAND flash pricing trends?

Compare that to the constant coverage of AI chatbots, reasoning models, and robotic announcements.

The memory stocks outperform AI trade reality reveals an important investing lesson: sometimes the best returns come from unglamorous necessities, not exciting headlines.

Multiple Viewpoints: Bulls, Bears, and Everyone In Between

The Bullish Case for Memory

Those who believe memory stocks outperform AI trade will continue point to several factors. Analysts bullish on why memory stocks outperform AI trade cite structural advantages:

Structural Demand Supporting This Trend

- AI data center buildouts are multiyear projects

- Edge AI applications are just beginning

- Automotive and industrial AI require local storage

- The “inference explosion” of 2026 needs massive memory capacity

Pricing Power Enabling These Returns

- Supply discipline among major manufacturers

- High barriers to entry (new fabs cost $10+ billion and take years)

- Technology complexity increasing (HBM4 production is extraordinarily difficult)

Favorable Cycle Dynamics Explaining This Performance

- We’re early in what analysts call a “memory supercycle”

- The industry learned from past overcapacity mistakes

- Capital discipline is replacing the old boom-bust pattern

Wedbush analyst Dan Ives compared buying Micron at current valuations to “getting a Mickey Mantle signed card at a garage sale.” His enthusiasm reflects the memory stocks outperform AI trade conviction among many Wall Street analysts.

The Cautious Perspective

Bears and skeptics raise legitimate concerns about how long memory stocks outperform AI trade leaders. Those questioning the sustainability of memory stocks outperform AI trade returns point to historical patterns:

Cyclicality Concerns Challenging This Trend’s Durability Memory markets are notoriously volatile. Today’s shortage can become tomorrow’s glut if manufacturers overinvest. The industry has a long history of boom-bust cycles that destroyed shareholder value. Whether this dynamic persists long-term depends on avoiding historical mistakes.

Overcapacity Risks Samsung, SK Hynix, and Micron are all expanding capacity. New facilities in China add supply uncertainty. At some point, production will catch up with demand. When it does, the thesis may need revision.

Macro Sensitivity If the global economy slows, AI spending could decelerate. Interest rate uncertainty in 2026 adds another variable. Geopolitical tensions could disrupt supply chains unpredictably.

Morningstar analyst David Sekera noted that while memory stocks outperform AI trade expectations now, “as more supply comes online over the next couple years, margins will normalize and fall.” He views memory as fundamentally a commodity-oriented product, despite the current AI-driven supercycle. His analysis tempers the memory stocks outperform AI trade enthusiasm with important caveats.

Global Relevance: From Silicon Valley to Shenzhen

Why This Matters Across Markets

The memory stocks outperform AI trade dynamic isn’t just a US market phenomenon. It has implications spanning continents.

United States

- Micron remains the only major memory producer based in America

- National security implications of memory supply chains

- Investment flows into domestic semiconductor capacity

China

- Ongoing expansion of memory manufacturing capability

- Trade restriction impacts on advanced chip access

- Domestic demand for AI infrastructure growing rapidly

South Korea

- Samsung and SK Hynix control roughly 60% of the global memory market

- HBM leadership position increasingly valuable

- Currency and export dynamics affecting returns for local investors

India

- IT services sector depends on global AI infrastructure buildout

- Growing domestic data center market

- Investment opportunities in multinational semiconductor plays

Russia and Other Markets

- Supply chain diversification concerns

- Alternative technology partnerships emerging

- Regional demand patterns influencing global allocation

The geographic spread of memory manufacturing means that when memory stocks outperform AI trade names, the benefits and risks distribute differently across regions. Korean investors get direct exposure through domestic champions. American investors benefit from Micron’s position but face currency considerations with Korean stocks. Asian emerging markets see second-order effects through supply chain participation. Understanding how memory stocks outperform AI trade globally requires this regional perspective.

The Numbers: Verifying the Performance

Let’s put some concrete figures behind why memory stocks outperform AI trade narrative:

Memory Stock Performance (2025)

| Company | Stock Return | Key Driver |

|---|---|---|

| SanDisk (SNDK) | +871% | NAND flash pricing surge |

| Micron (MU) | +240% | HBM demand, margin expansion |

| Western Digital (WDC) | +282% | HDD and flash strength |

| SK Hynix (000660.KS) | ~200% | HBM market leadership |

Comparative AI Stock Performance

While memory stocks outperform AI trade stalwarts, some of those former leaders showed mixed results. Software companies faced valuation compression. Some cloud providers struggled with capital spending concerns. Even Nvidia, still performing well, saw more modest gains compared to the memory sector.

Financial Metrics That Matter

Micron’s fiscal Q1 2026 results illustrate why memory stocks outperform AI trade expectations on a fundamental basis:

- Revenue: $13.64 billion (up 57% year-over-year)

- GAAP EPS: $4.60 (third consecutive quarter of record earnings)

- Gross Margin: Expanding toward 68% in Q2 guidance

- HBM Revenue Projection: $100 billion TAM by 2028

These aren’t speculative projections. They’re actual results from a company that can’t produce enough chips to meet demand.

What Comes Next: Forward-Looking Considerations

Factors to Monitor

If you’re trying to understand whether memory stocks outperform AI trade leaders going forward, watch these indicators:

Memory Pricing Sustainability

- Quarterly contract price negotiations

- Inventory levels at major customers

- Capacity utilization rates

AI Infrastructure Spending Trends

- Hyperscaler CapEx guidance updates

- Enterprise AI adoption rates

- Edge AI deployment velocity

Earnings Discipline

- Margin trajectory at Micron, Samsung, SK Hynix

- Inventory management practices

- Capital expenditure plans vs. demand forecasts

The Agentic AI Factor

A crucial variable for 2026 is the rise of “agentic AI”—autonomous systems that reason, plan, and execute tasks without constant human oversight.

These systems are memory-hungry in ways previous AI applications weren’t. They need:

- Persistent memory for maintaining context

- Fast storage for rapid information retrieval

- Edge processing capability for local operation

If agentic AI adoption accelerates as expected, the conditions supporting memory stocks outperform AI trade dynamics could extend well into 2027. The memory stocks outperform AI trade pattern may prove more durable than skeptics expect.

Frequently Asked Questions

Why are memory stocks outperforming the broader AI trade in 2026?

Memory stocks outperform AI trade benchmarks primarily because of a severe supply-demand imbalance. AI workloads require enormous amounts of memory and storage, but manufacturing capacity hasn’t kept pace. This scarcity gives memory producers unprecedented pricing power, translating directly into higher margins and stock returns. The memory stocks outperform AI trade phenomenon reflects fundamental economics.

Is the memory stock rally sustainable or is it a bubble?

The case for sustainability rests on structural demand (AI buildout is multiyear), supply discipline (manufacturers learned from past cycles), and technological barriers (new capacity takes years to build). However, memory markets are historically cyclical, and today’s shortage could become tomorrow’s glut if demand slows or capacity expands too aggressively.

Which memory stocks have benefited most from the AI boom?

SanDisk leads with an 871% gain since its February 2025 spinoff, followed by Micron (+240%), Western Digital (+282%), and SK Hynix (~200%). These companies all benefit from different memory types: HBM for AI accelerators, DRAM for servers, and NAND flash for storage.

How does the AI trade cooling affect memory stocks?

Interestingly, memory stocks outperform AI trade names partly because of the cooling. As investors question when AI spending will produce returns, capital rotates toward companies with proven profits—like memory producers enjoying record margins. The cooling validates their thesis: AI requires real infrastructure, not just software promises.

Should investors in India, China, or other emerging markets care about memory stocks?

Absolutely. Memory stocks outperform AI trade dynamics affect global supply chains. Chinese investors face trade restriction considerations but also domestic demand opportunities. Indian investors see IT services exposure and growing data center markets. The semiconductor supply chain is genuinely global, making this relevant across geographies.

What are the main risks to the memory stock bull case?

Key risks include: cyclical overcapacity if manufacturers overinvest, macro slowdown reducing AI spending, geopolitical disruptions to supply chains, and technology transitions that could favor new entrants. Memory markets have historically been volatile, and current high margins may attract capacity investment that eventually depresses prices.

How do memory stocks compare to AI software stocks for long-term investors?

Memory stocks outperform AI trade software names in the current environment because they have actual scarcity and pricing power. Software companies face more competition and less clear moats. However, memory is ultimately more commodity-like, while software can theoretically scale infinitely without capacity constraints. Portfolio diversification across both may be optimal.

The Bottom Line: A Shift Worth Understanding

The divergence between memory stocks and headline AI names underscores something fundamental about how technology investment works: the companies that capture value aren’t always the ones generating headlines.

For two years, the AI investment playbook was simple: buy processors, buy software, buy cloud. That playbook delivered extraordinary returns. But markets evolve, and the memory stocks outperform AI trade phenomenon represents the next chapter.

Whether you’re a tech-savvy investor in Silicon Valley, a portfolio manager in Hong Kong, a retail trader in Mumbai, or a market watcher anywhere else in the world, understanding why memory stocks outperform AI trade leaders matters.

It’s not that AI is over—far from it. The infrastructure buildout is accelerating, agentic AI is arriving, and capital spending continues at record levels. But the beneficiaries are shifting. The bottleneck has moved. And in markets, finding the bottleneck is often how you find the opportunity.

Key Takeaways:

- Memory stocks outperform AI trade expectations due to fundamental supply-demand imbalance

- AI workloads require massive memory capacity, creating structural demand

- Manufacturing constraints give producers pricing power

- The AI trade is cooling as investors demand proof of ROI

- Global investors across all markets have exposure to this theme

- Risks include cyclical overcapacity and macro sensitivity

- The trend may continue through 2026-2027 based on demand projections

Whether this trend holds will depend on earnings discipline, demand durability, and broader market conditions. But for now, the memory stocks outperform AI trade reality offers a valuable lesson about where value actually accumulates in technology revolutions.

Sometimes the boring infrastructure wins.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. The memory stocks outperform AI trade analysis presented reflects market conditions as of early January 2026. Readers should conduct their own research and consult qualified financial advisors before making investment decisions. Past performance does not guarantee future results.

Have thoughts on why memory stocks outperform AI trade expectations? Share your perspective in the comments below. And if you found this analysis valuable, consider sharing it with other investors who might be missing this important market shift.

By:-

Animesh Sourav Kullu is an international tech correspondent and AI market analyst known for transforming complex, fast-moving AI developments into clear, deeply researched, high-trust journalism. With a unique ability to merge technical insight, business strategy, and global market impact, he covers the stories shaping the future of AI in the United States, India, and beyond. His reporting blends narrative depth, expert analysis, and original data to help readers understand not just what is happening in AI — but why it matters and where the world is heading next.