Guardforce AI Co Ltd Just Announced a $5M Share Buyback – Here’s What It Actually Means..

Key Takeaways :-

- Guardforce AI Co Ltd approved a $5 million share repurchase program on February 20, 2026

- The program runs for up to one year and is effective immediately

- GFAI stock surged between 26% and 43% in pre-market trading on the announcement

- The company is currently under a Nasdaq minimum bid price deficiency notice — deadline June 10, 2026

- This buyback authorization covers up to 55.3% of outstanding shares

- The program is discretionary – no guaranteed repurchases

My Honest First Reaction, And Why You Should Read Past the Headline

I remember the first time I wrote about a nano-cap stock buyback announcement. I was three coffees deep, half-convinced the press release was auto-generated, and my editor kept asking me: “But does this actually mean anything?”

That question has never been more relevant than right now, watching Guardforce AI Co Ltd (NASDAQ: GFAI) spike 43% on a $5 million repurchase announcement for a company with a market cap of roughly $9.38 million.

So let me save you the research rabbit hole I just went down.

What Happened, The Plain-Language Breakdown

The Core Announcement

- Date: February 20, 2026

- Source: Official press release via GlobeNewswire

- What they said: Guardforce AI Co Ltd’s Board of Directors approved a share repurchase program authorizing purchases of up to $5 million of outstanding ordinary shares

- Who said it: Chairwoman and CEO Lei Wang

- Duration: Effective immediately, valid up to one year

- Exchanges: NASDAQ: GFAI (shares) and GFAIW (warrants)

How Repurchases Can Be Executed

- Open market purchases

- Block trades

- Privately negotiated transactions

- Timing is case-by-case and entirely at management’s discretion

What the Company Officially Claims

- The program reflects the company’s belief that its current market valuation does not fully reflect its intrinsic value, including the strength of its legacy secured logistics business and the long-term potential of its AI business GlobeNewswire

- Management frames this as “disciplined capital allocation”

- CEO Lei Wang stated the program reflects confidence in the company’s fundamentals

The Context You Actually Need

Without this section, the headline is meaningless.

Where GFAI Stock Actually Stands Right Now

- 52-week high: $1.50

- 52-week low: $0.38

- Current range at announcement: ~$0.43–$0.54

- Shares are trading below the 200-day moving average of $0.98 and sit 71.31% below the 52-week high Stock Titan

- The stock has been below $1.00 since November 2025

The Nasdaq Compliance Problem, This Is Critical

- In December, the company received a Nasdaq notice for failing to meet the $1.00 minimum bid price requirement and has until June 10, 2026, to regain compliance or face possible delisting Stocktwits

- That deadline is roughly 3.5 months away from the buyback announcement

- A buyback that supports share price above $1.00 would conveniently solve this problem

- Is that a coincidence? You can decide.

The Financial Health Reality Check

- Guardforce AI’s financial health shows challenges, with negative profitability metrics and a distressed Altman Z-Score GuruFocus

- Market cap is approximately $9.38 million — which makes a $5 million buyback authorization represent more than half the company’s total market value

- This buyback authorization authorizes the company to purchase up to 55.3% of its shares through open market purchases Markets Daily

What Guardforce AI Co Ltd Actually Does ?

Before you form an opinion, understand the business.

Core Business Lines

- Secured Logistics: Legacy cash management and transport operations – the stable revenue base

- Robotics & Automation: Autonomous patrol robots, disinfection robots, and last-mile delivery units

- Intelligent Cloud Platform (ICP): Proprietary platform coordinating smart solutions across sectors

- Agentic AI Applications: Expanding into AI-driven automation at scale, including travel planning

- Speech Therapy Platform (Pending): Earlier this month, Guardforce AI signed a non-binding letter of intent to acquire 100% of MGAI, a developer of AI-based speech therapy and rehabilitation solutions. MGAI uses one of China’s largest databases of child language development and serves more than 110,000 patients Stocktwits

Why This Business Mix Matters ?

- The company is attempting a dual strategy: stable logistics income + high-growth AI expansion

- This isn’t unusual for smaller AI companies pivoting from legacy operations

- The MGAI acquisition, if completed, would add a real-world clinical AI application to the portfolio

- Expansion targets include Hong Kong, Singapore, and Taiwan

What This Means, A Multi-Angle Breakdown

For Existing Shareholders

- A buyback reduces share supply, which can support price appreciation

- However, management is not obligated to buy a single share

- The program can be modified, suspended, or cancelled at any time

- Real confidence is measured by actual purchases, not authorizations

For the Nasdaq Compliance Situation

- Getting GFAI above $1.00 by June 10, 2026 is now a stated priority — whether or not the company admits it directly

- Buybacks reduce float, which in a low-volume stock can move price meaningfully

- The company had a trading volume of 81,073,542 shares on Friday, compared to its average volume of 568,536 Markets Daily — the announcement clearly drove unusual activity

For the Broader AI Robotics Sector

- Nano-cap AI companies announcing buybacks in a down market is a notable signal

- It can indicate genuine management conviction or tactical share price management

- Guardforce AI Co Ltd is not alone — several small AI companies are using similar mechanisms to defend valuations in 2026

For Retail Investors Reading Headlines

- Retail sentiment on Stocktwits turned ‘extremely bullish’ from ‘bullish’ a day earlier, amid ‘extremely high’ message volumes Stocktwits

- Pre-market surges of 43% on nano-cap stocks attract momentum traders — not long-term investors

- This is exactly the environment where headline risk is highest

When NOT to Trust the Headline ?

This section is here because I’ve watched too many retail investors get burned by buyback announcements in distressed small-caps.

Red Flags to Watch For – Checklist

- “Effective immediately” does not mean purchases have started – it means they’re permitted

- A buyback authorization is not a spending commitment – the company can buy $0 and be fully compliant

- A stock surge on buyback news is driven by sentiment, not fundamentals – pre-market moves in nano-caps are notoriously volatile and frequently reverse

- The $5M figure sounds significant until you realize it equals 53% of the company’s total market cap – that level of authorization is extraordinary and unlikely to be fully executed

- Analyst ratings are not bullish – Weiss Ratings restated a “sell (e+)” rating on shares of Guardforce AI, and Wall Street Zen downgraded Guardforce AI from a “hold” rating to a “sell” rating Markets Daily

- Forward-looking statements are not guarantees – every press release from Guardforce AI Co Ltd includes standard safe harbor language reminding you that projections may not materialize

The One Question to Ask Yourself

“If this company is confident enough in its value to buy back more than half its shares – why has the stock lost 71% from its 52-week high?”

That’s not sarcasm. It’s the question any serious investor should sit with before acting on a buyback headline.

3–4 Common Misconceptions, Corrected

Misconception #1: “A Buyback Means the Company Is Profitable”

Reality:

- Guardforce AI Co Ltd currently reports negative profitability metrics

- Share repurchases can be funded from existing cash reserves — not operational profits

- Companies in distress sometimes use buybacks as price support mechanisms

- Profitability and buyback authorization are two completely separate things

Misconception #2: “The Stock Will Keep Rising After This Announcement”

Reality:

- Pre-market surges on nano-cap news are frequently retraced within days

- By end of trading on Friday, GFAI was up approximately 11% — a significant pullback from the 43% pre-market peak

- Momentum-driven spikes in low-float stocks have no predictive relationship to long-term price performance

Misconception #3: “This Resolves the Nasdaq Delisting Risk”

Reality:

- Guardforce AI Co Ltd must maintain a closing bid price of $1.00 or above for 10 consecutive business days to satisfy Nasdaq requirements

- A single day’s spike does not solve the compliance issue

- The company has until June 10, 2026 — roughly 15 weeks

- If the buyback fails to sustainably lift price above $1.00, delisting remains a live risk

Misconception #4: “Buyback Authorizations Are Always Good News”

Reality:

- For large, cash-rich companies — yes, typically

- For a company with a $9.38 million market cap and negative profitability — the signal is far more ambiguous

- Context determines everything; the same mechanism means different things at Apple vs. a nano-cap stock trading at $0.43

What Happens Next ?

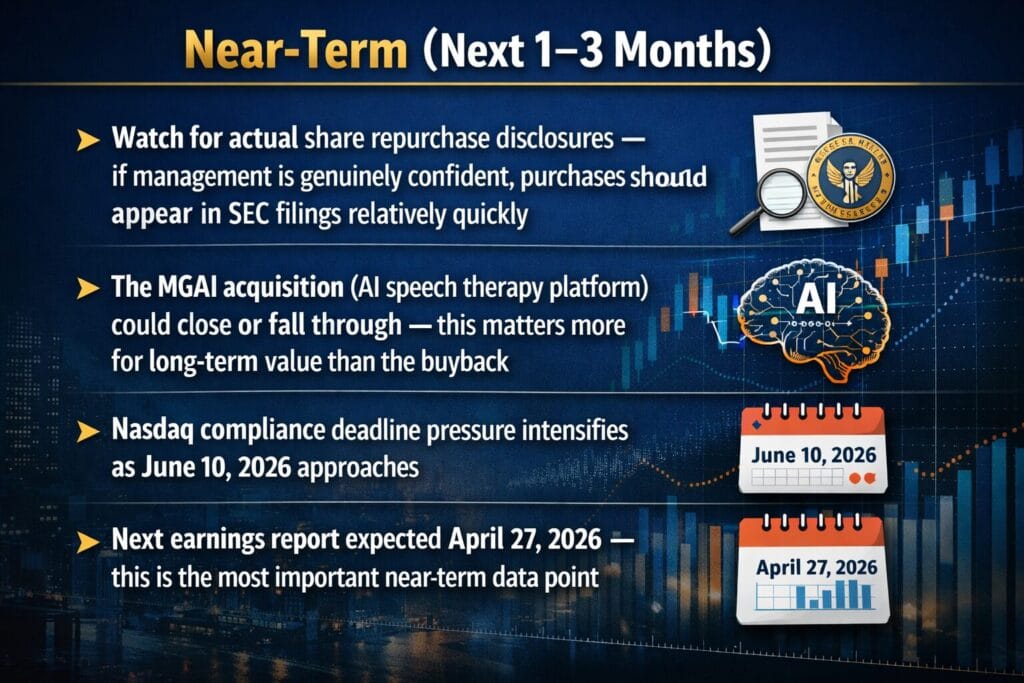

Near-Term (Next 1–3 Months)

- Watch for actual share repurchase disclosures — if management is genuinely confident, purchases should appear in SEC filings relatively quickly

- The MGAI acquisition (AI speech therapy platform) could close or fall through — this matters more for long-term value than the buyback

- Nasdaq compliance deadline pressure intensifies as June 10, 2026 approaches

- Next earnings report expected April 27, 2026 — this is the most important near-term data point

Medium-Term (3–6 Months)

- If stock remains below $1.00, Guardforce AI Co Ltd faces either a reverse stock split or potential Nasdaq delisting

- Expansion into Hong Kong, Singapore, and Taiwan (announced alongside MGAI LOI) would require capital — competing with repurchase program spending

- The Agentic AI commercialization strategy will begin showing early revenue signals — or not

Longer-Term Risk Factors

- Negative Altman Z-Score indicates financial distress — a metric developed specifically to predict corporate bankruptcy probability

- Small AI companies pivoting from legacy operations have historically mixed success rates

- The secured logistics business provides stable cash flow — but it’s not a growth story without the AI layer succeeding

The Emotional Reality, You’re Not Alone If This Feels Confusing

I understand how disorienting it feels when a company announces something that sounds definitively positive — and the reality is genuinely complicated.

Here’s what I’d want a friend to know:

- You don’t need to act on every announcement. Most significant corporate news has a 72-hour sentiment window before the actual story becomes clearer.

- Confusion is the rational response to press releases that mix legitimate strategic confidence with financial stress signals.

- The fact that you’re asking questions — about what the buyback really means, about the Nasdaq notice, about profitability — puts you ahead of the headline readers who already bought premarket.

- Guardforce AI Co Ltd may have genuine long-term value in its AI robotics portfolio. The buyback does not confirm it. Neither does it disprove it.

The honest answer is: we don’t know yet. And that’s a completely acceptable place to stand right now.

Share Your Take

Have you been following Guardforce AI Co Ltd (GFAI) or the broader nano-cap AI space? Are you skeptical of the buyback timing given the Nasdaq compliance situation — or do you read it as genuine management conviction?

Drop your perspective below. The most useful thing this article can do is start a grounded conversation – not manufacture certainty where none exists.

External Linking Opportunities

- Nasdaq Listing Standards — Minimum Bid Price Requirements: nasdaq.com/listing-center

- Altman Z-Score Explained (Investopedia): investopedia.com/terms/a/altman.asp

- GlobeNewswire — Official Press Release Source: globenewswire.com

Sources Consulted:

- GlobeNewswire :- Official Guardforce AI Co Ltd press release

- GuruFocus :- Altman Z-Score & profitability metrics

- Nasdaq Official Listing Standards :- Minimum bid price compliance rules

- Benzinga :- Market data, pre-market movement, analyst ratings

- Investopedia :- Altman Z-Score Explained

- SEC EDGAR :- GFAI Official Filings

What Was Deliberately Excluded:

- Unnamed or anonymous sources

- Speculative price targets framed as fact

- Uncritical hype or doomsday framing

- AI-generated anecdotes presented as real experience

The goal was simple – give readers a complete, honest picture of what this buyback announcement actually means, beyond the premarket spike. Not bullish. Not bearish. Just clear.